Blockchain technology allows residents with solar PV panels to sell excess energy to other residents.

In Africa, the demand for electricity largely exceeds supply. Nigeria’s shortage of 173,000MW (for a nation whose current energy needs is around 180,000MW) gave rise to large-scale imports of noisy and polluting power generating sets.

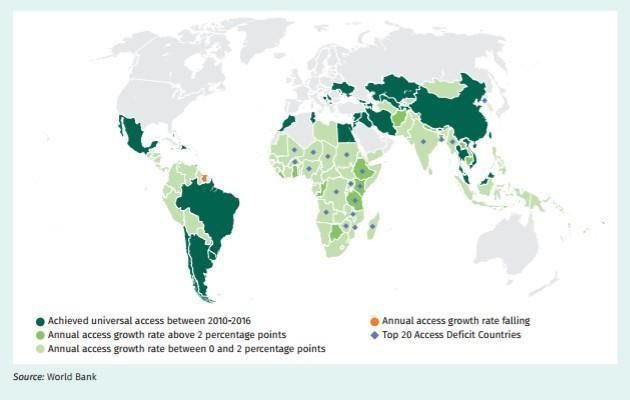

Annual increase in electricity access rate in 2010-2016 in countries where demand for electricity exceeds supply.

Annual increase in electricity access rate in 2010-2016 in countries where demand for electricity exceeds supply.

Most sub-Saharan African countries experience the same. In rural areas in Rwanda, where over 70% of the population lives, only 18% of the population has access to electricity. Large numbers of households and public buildings in rural communities are not connected to their state-backed power grid. Urban dwellers and medium-sized enterprises linked to the grid still cannot be certain of having electricity all day. The government of Rwanda has set a target to achieve successful electrification by 2024.

The cost of generation and distribution of power is high. Economic and political reasons mean it will take a lifetime for these communities to be considered. The UN Sustainable Development Goal #7, targeting universal energy access for all by 2030, among other international agreements is driving a global consensus on renewable energy in off-grid communities.

In several African countries, renewable energy has been the focus of development strategy and investment. Huge investments and support from the African Development Bank (AfDB), Overseas Private Investment Corporation and World Bank in solar PV and wind energy are yielding results.

This is because the easiest and most affordable way to get electricity to rural communities in Africa is with a decentralized energy source, such as solar PV and wind energy. These communities, which are not connected to the national power grid, will lift the government’s burden of investing in large-scale plants to meet the growing demand for electricity.

Togo, Nigeria and the Democratic Republic of Congo are doing well in setting up policies and regulatory frameworks in this sector. In an ambitious plan to achieve universal access to energy across the continent by 2025, the AfDB is mobilizing capital to help realize the continent’s potential to generate at least 160GW by 2025.

While this is laudable, experts say the market penetration of green energy in Africa is low and, up until now, the success of electrification plans focuses on the number of connections made and megawatts installed rather than the end use of that power.

There is, however, an ongoing shift in how electrification success should be measured. In Africa, communities need to have appliances, classrooms, equipment, irrigation systems, and so on, ready and available to be powered by electricity. The energy supplied has to meet a demand that boosts productivity.

There is no need for the expansion of decentralized energy if the end use does not improve lives and meet critical needs. The World Bank is using this same measure to check the progress in access to electricity.

The innovation to accelerate access through decentralized energy is tilting more towards demand management and distribution, using connectivity and data.

With the emergence of blockchain (a protocol that eliminates intermediaries), it is possible to establish an auditable encrypted ledger that can record energy consumption, credit histories (which are relevant when there is a need for access financing), as well as provide energy trading between households; giving consumers more control of their energy requirements and consumption.

In 2017, a non-profit, Energy Web Foundation (EWF), started developing an open source, scalable blockchain platform with the aim of creating a market standard for the energy industry to build upon and run their own blockchain-based solutions.

Discussion about this post