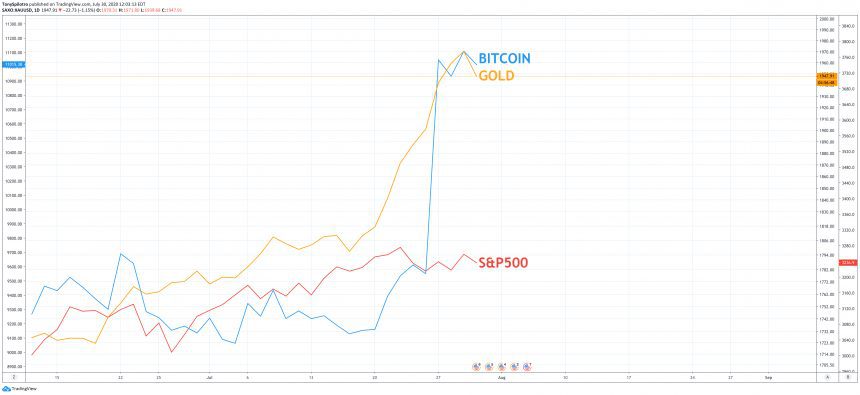

Bitcoin price this week exploded from its tightening consolidation range and within a day, broke through resistance at $10,000 and touched $11,400. The breakout followed gold setting a new record, rather than staying lock and step with stocks as the crypto asset has as of late.

Comparison charts show that the leading cryptocurrency by market cap may have ditched its correlation with the S&P 500 in favor of the soaring precious metal. If this is the case, this will benefit the entire crypto space – here’s why.

Bitcoin Swaps Correlation With S&P 500 For Gold

Gold set a new all-time high this week, just ahead of the United States government revealing details of their latest efforts to stimulate the economy.

The dollar dumping, as a result, sent safe haven assets like precious metals soaring as more money supply poured into the already flooded market.

The latest round of stimulus adds another $1 trillion to the Fed’s balance sheet, prompting investors to flock toward assets that could act as a hedge against the expected inflation. Bitcoin has been recently called the “fastest horse in the race against inflation” by billionaire hedge fund manager Paul Tudor Jones.

Related Reading | Gold Rally Peaks: 5 Reasons Bitcoin Will Likely Outperform The Precious Metal

In this latest shakeup in the dollar, not only did gold benefit but so did Bitcoin. In fact, Bitcoin more closely followed gold’s reaction to the continued printing of money supply than it did to the stock market.

The leading cryptocurrency by market cap has been uncannily correlated to the S&P500 since Black Thursday. But as the dollar collapsed this week, the correlation appears to have ended.

BTCUSD / SPX / XAUUSD Correlation Comparison Chart | Source: TradingView

How The Crypto Market Will Benefit From Comparison With Precious Metals

The stock market correlation caused Bitcoin and the rest of the crypto market to crash mid-March, just as the assets had been breaking out of