A fractal has been discovered in silver and altcoins that mimics the early days of Bitcoin. Silver is already on the move, starting to follow the fractal, but the crypto market is lagging behind. If – like Bitcoin has followed gold – altcoins continue to follow silver, an explosive surge is just around the corner.

Fractal Foretells Explosive Breakout in Altcoins Based on Early Days of Bitcoin

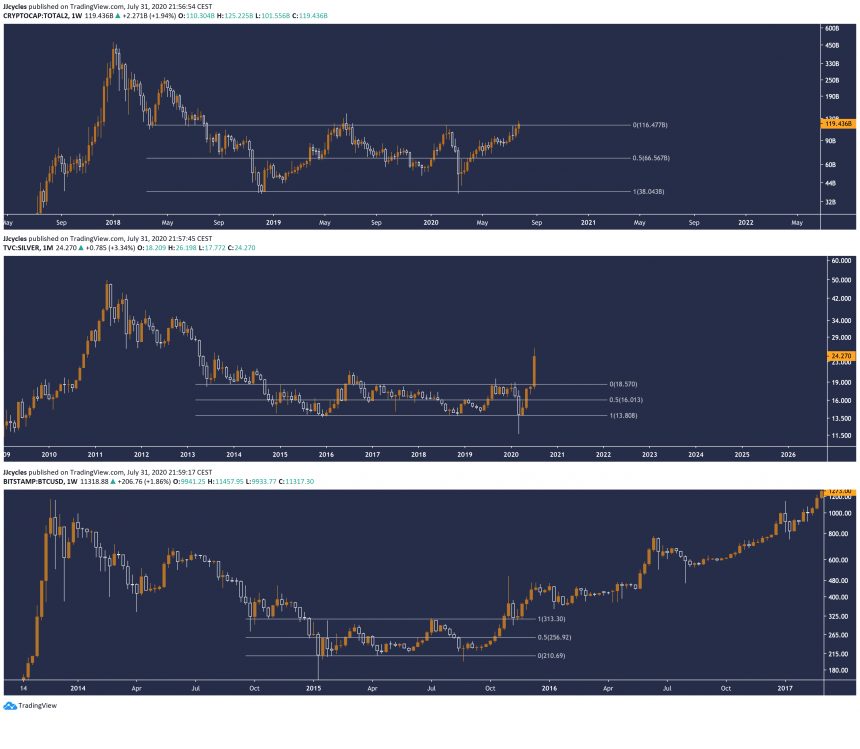

According to a fractal discovered by one crypto analyst, both silver and the total altcoin market cap appear to be mimicking early Bitcoin. Notably, the two assets classes are following the path of Bitcoin’s bear market bottoming process that took place from 2015 through 2016.

Altcoins and silver have remained in a similar sideways accumulation range, where investors may have been loading up on the scarce assets ahead of a markup phase.

Related Reading | Are Altcoins Silver To Bitcoin As Gold? Unusual Crypto Correlation Discovered

The same sort of bottoming pattern also played out in the gold market, and the asset not only has been in an increasingly strong uptrend, but it has recently set a new all-time high.

If the assets do continue to follow the original crypto asset’s bear market bottoming fractal, as soon as the range is broken, an explosive pump takes place next. Silver just had its surge, nearly doubling in value over the last month. Is it now altcoins time to shine?

XAGUSD / Total 2 (Alt Market Cap) / BTCUSD Historic Fractal Comparison | Source: TradingView

Will Crypto Follow Silver and Gold As The Fractal Suggests?

Fractals are repeating patterns that play out in price charts of financial assets like crypto. However, they are a polarizing topic in the trading world. Some analysts claim fractals only cloud judgment, while others give ample credence to the repeating patterns.

These repeating patterns are found all over nature, in everything from snowflakes to the veins of leaves, and are often based on geometrical shapes and Fibonacci ratios. Geometrical shapes drawn on price charts can tip traders off to