The price of Curve Finance’s governance token CRV spiked by more than 100 percent as the decentralized exchange (DEX) experienced a massive surge in trade volume.

Earnings

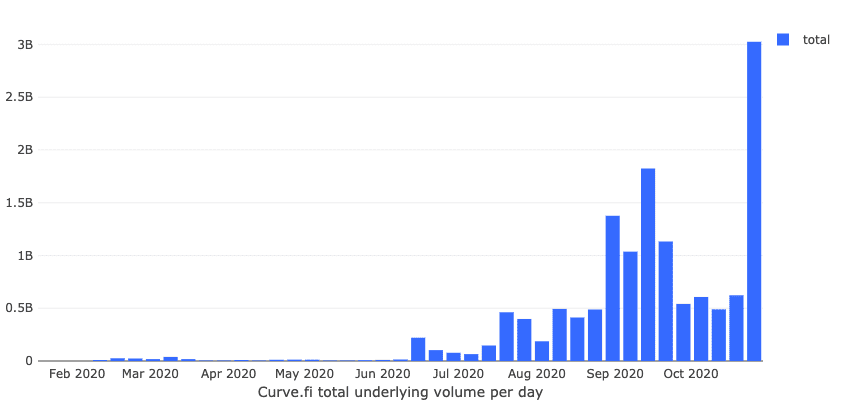

Curve Finance processed about $2.8 billion worth of trades on Monday, almost 450 percent higher than its previous record high in September 2020. The jump in its trade volume coincided with a similar spike in the UniSwap decentralized exchange – of about $2 billion.

Curve.fi total underlying volume. Source: Dune Analytics

Together, the DEX platforms reported a $5.8 billion in total volume on Monday. Nevertheless, the reason why their daily trade activities rose to a record high was a hack at Harvest Finance, a liquidity pool that lost about $25 million to a flash loan exploit.

Researchers found that both Curve and UniSwap enabled the hacker to purchase, sell, and swap borrowed USDC and USDT tokens automatically by offering their liquidity pools. They, in turn, earned higher trading fees, with the Curve pool adding about $1.14 billion in CRV fee reserves on Monday alone.

CRV Pumps

The earnings partially explain why the CRV/USD exchange rate rose by 61 percent on Monday as it established a multi-week high at $0.689.